Chapter 380 of the Texas Local Government Code authorizes Texas municipalities to offer tax grants, performance grants or redevelopment grants to incent development and redevelopment. These agreements are approved on a case-by-case basis and tailored to the specific needs of the project.

Incentives

In the heart of the Texas Triangle, College Station is conveniently located less than 3 hours from the Dallas/Fort Worth metroplex, 2 hours from Austin, and just an hour from Houston. With brief commute times, superb quality of life, and close proximity to major Texas cities, College Station emerges as a strategic choice for ambitious companies. As the home of Texas A&M University, College Station fosters intimate collaboration with individuals within a world-class university environment.

Whether embarking on a new business venture or contemplating a relocation, College Station and its network of economic development allies offer a diverse range of robust resources to bolster your success. If you would like additional information regarding the City of College Station and potential incentives available, please connect with our Economic Development Staff.

Local

Tax Increment Finance/Reinvestment Zones

TIF (Tax Increment Financing) and TIRZ (Tax Increment Reinvestment Zones) districts are used to support private developers by covering the costs of public infrastructure improvements that might otherwise hinder a project. The funding for these improvements comes from the increased tax revenue generated by the new development within the district or zone. By covering the costs of essential improvements, these programs make redevelopment projects more feasible for developers while benefiting the community as a whole.

|

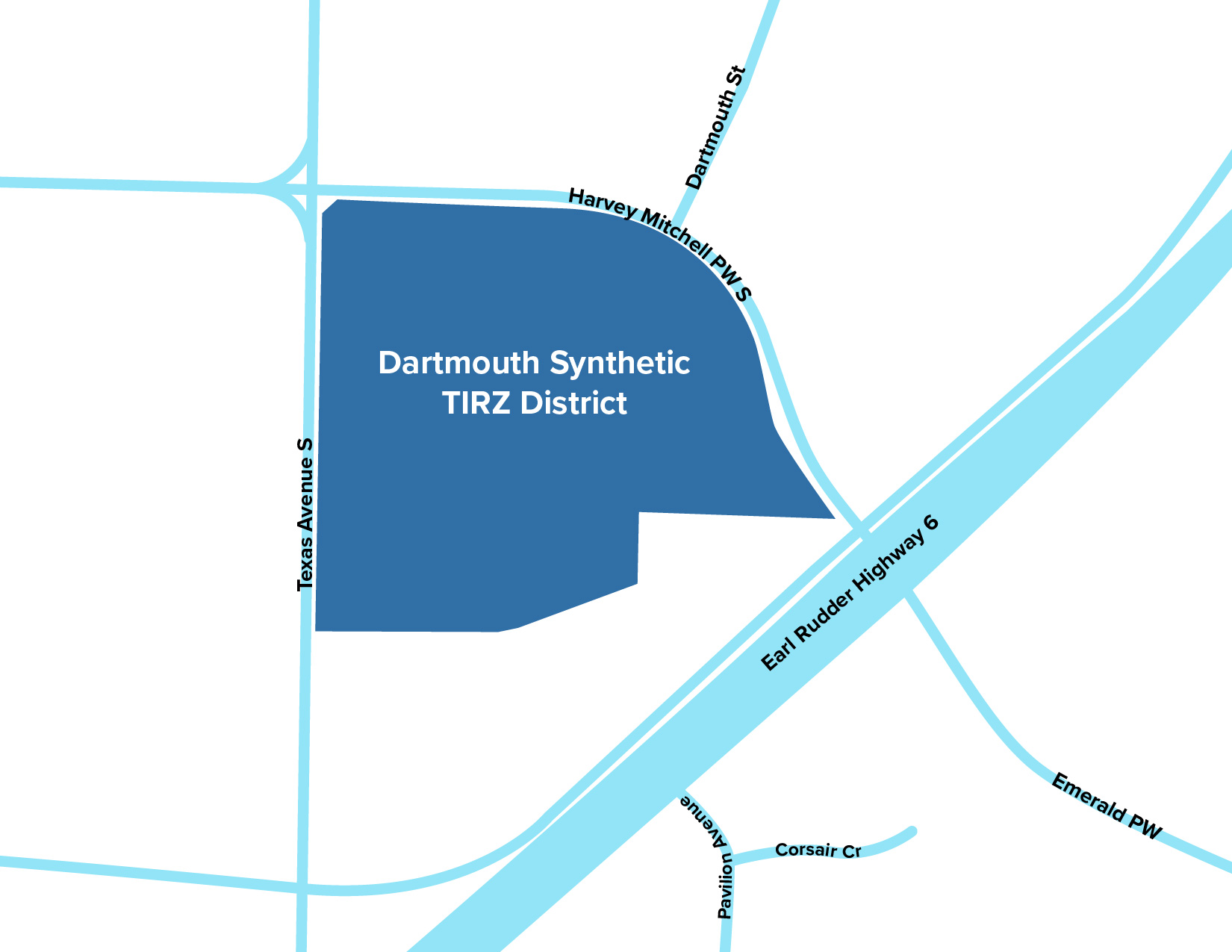

Dartmouth Synthetic TIRZ |

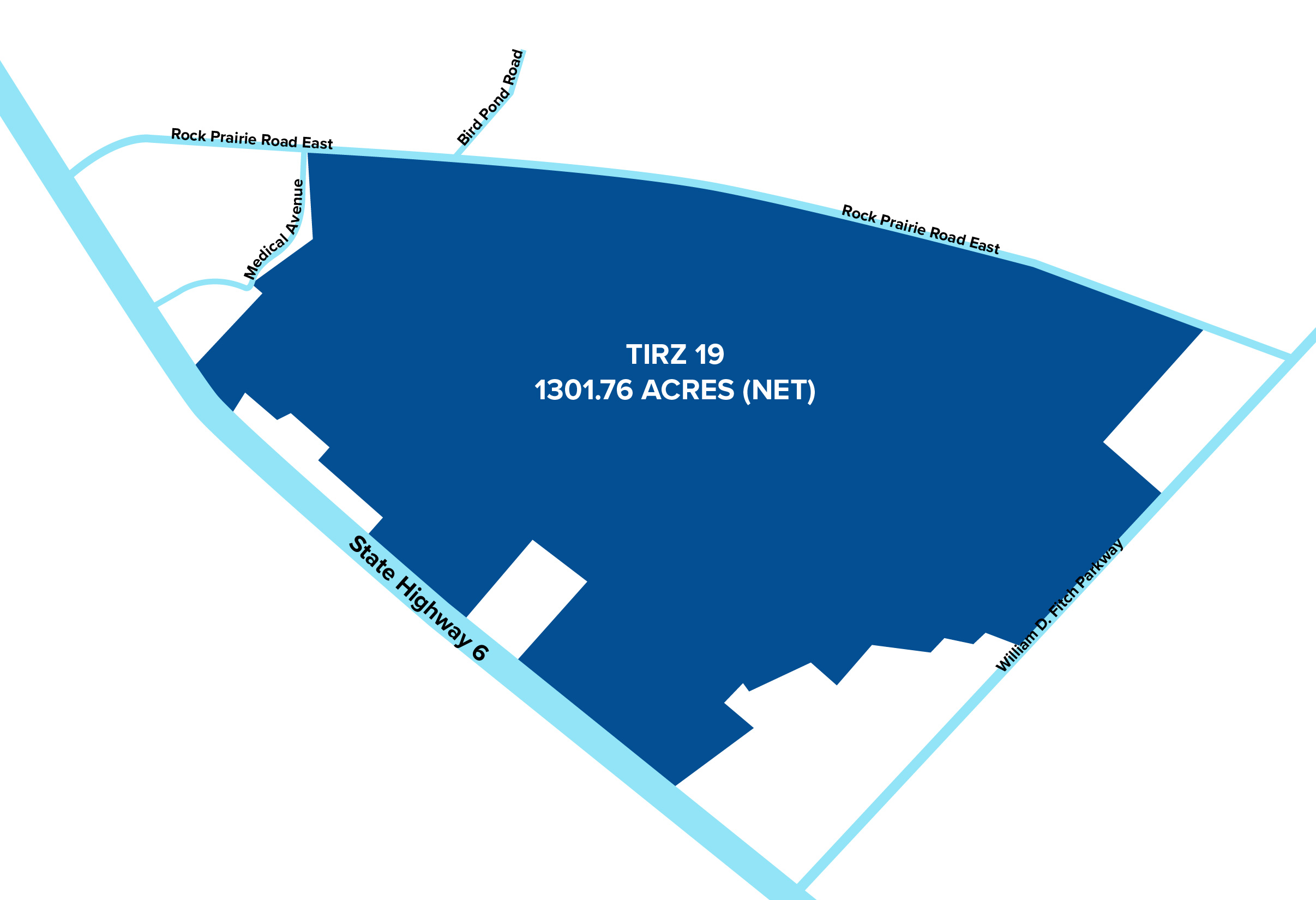

East Medical District TIRZ No. 19 |

State

The Texas Enterprise Fund offers an opportunity for companies deciding between Texas and another state to receive a cash grant. This initiative acts as a performance-driven financial incentive for companies aiming to bring substantial capital investment and create new job opportunities in the state's economy.

The Texas Enterprise Zone Program (EZP) is a state initiative aimed at promoting private investment and employment growth in economically challenged regions by providing refunds on state sales and use taxes.

Texas Jobs, Energy, Technology, & Innovation (JETI)

This program offers an opportunity for a company, school district, and the Texas Governor’s Office to establish a mutual agreement entailing a 10-year limitation on the school district's Maintenance and Operations (M&O) tax appraised value, set at 50%, provided that specific job and investment criteria are met.

The Skills Development Fund provides an opportunity for companies to partner with select educational providers, utilizing grant funds to train full-time, paid employees. The main objective is to enhance the skill level and increase the wages of the Texas workforce.

Federal

A federally initiated program designed to spur growth in distressed communities by offering incentives in the form of capital gains tax abatements for those who invest eligible capital into Qualified Opportunity Zone assets.